Computer Vision in Insurance: Claims Processing Made Easy

Chase Hart | June 27th, 2022

Even as the big name insurance companies digitize much of the customer facing claims process, many homeowners know it remains a tedious process. While claims can now be submitted online or through a mobile app, the actual review and approval process is still done manually.

Once a claim is submitted and assigned to a claims adjuster, they review the photos or video submitted, but often also require an in person visual inspection – and when you consider how many claims large insurance companies receive, you can imagine how much time this adds to the process.

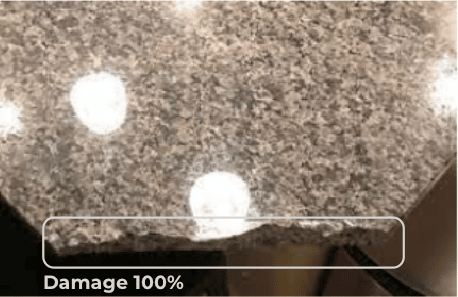

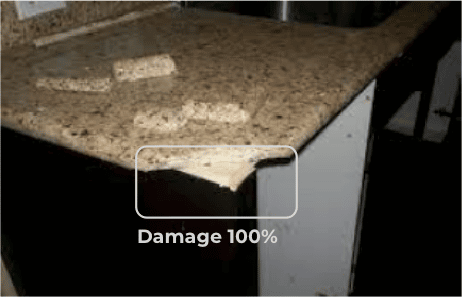

This is where computer vision comes in. Using Matroid’s software, insurance companies are able to upload images depicting a wide range of damage and train the model to detect the specific defects they are interested in, anything from stress cracks in the foundation to water damage – if you can see it, the model can too.

Models can be developed according to the specific requirements laid out in the insurance policies and trained in house. Simpler claims can be left to the computers, freeing up adjusters to focus their time on more complex insurance claims, ultimately speeding up the process for everyone.

Example of car damage being detected by Matroid

Building detectors for Insurance related use cases is one of many examples of Matroid helping to automate visual inspection in industrial IoT, improving operational productivity, whilst minimizing costs. To learn more about how Matroid could help you, get in touch with us today.

Building Custom Computer Vision Models with Matroid

Dive into the world of personalized computer vision models with Matroid's comprehensive guide – click to download today